Top 10 Exchange Software Development Features That Will Make An Impact in 2026 and Beyond

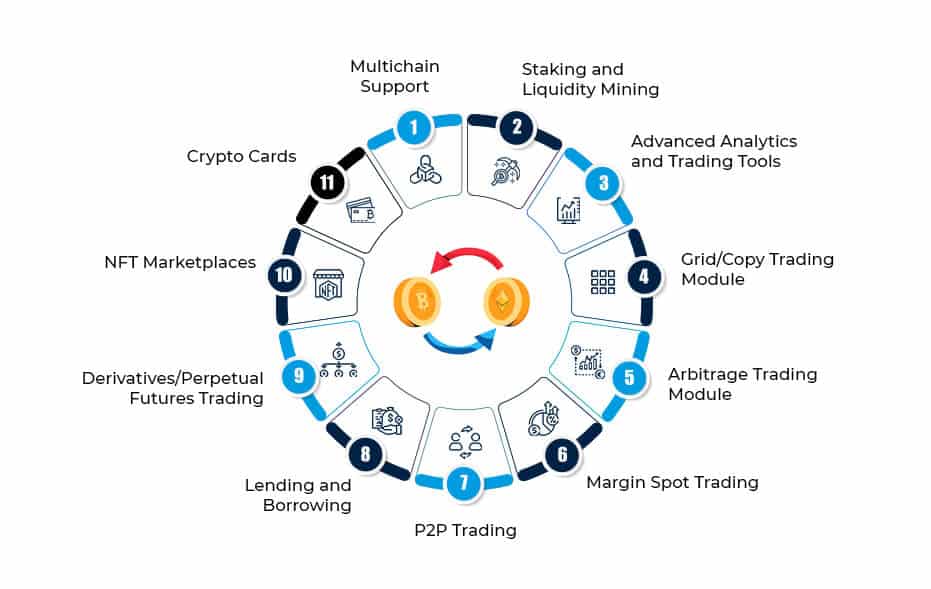

Now, let’s cover some intermediate and advanced exchange platform development features that can help exchanges get a competitive edge:

1. Multichain Support:

The days of single-chain supremacy are long gone. It’s time to embrace the blockchain multiverse. Users are increasingly seeking platforms that cater to the diverse functionalities offered by various blockchains. Integrate support for multiple blockchains (e.g., Ethereum, Solana, and Avalanche) during your exchange software development to attract a wider audience and broaden your user base.

2. Staking and Liquidity Mining:

Make your exchange a self-regulated entity by empowering users to contribute to the platform’s liquidity and stability by offering staking and liquidity mining incentives. With staking, users lock their funds with your platform for a set period, while in liquidity mining, they provide liquidity for specific trading pairs. Integrating both of these modules during exchange app development secures users’ interest for a longer period and offers liquidity and stability to your exchange.

3. Advanced Analytics and Trading Tools:

Want huge institutional investors to approach your exchange so that you can reap enormous profits? If so, attract serious traders by integrating advanced analytics and trading tools during your exchange platform development. Offering a variety of charting tools for technical analysis allows users to identify trends and make informed trading decisions. Similarly, technical indicators and real-time market data analysis access can enhance user activity on your trading platforms.

4. Grid/Copy Trading Modules:

Enable customers to capitalize on market trends with a smart grid trading bot that incorporates technical indicators and dynamic grid adjustments. Integrating these features during crypto exchange software development fosters user engagement and informed decision-making. Social copy trading with reputational scores also enables traders to copy successful traders based on verifiable performance metrics and community reputation.

5. Arbitrage Trading Module:

Let your customers unlock access to unhindered passive income with a cross-exchange arbitrage automation module that scans markets and executes trades itself. You can also step ahead and include a fail-safe flash loan arbitrage tool during exchange app development that performs complex arbitrage strategies with ease and maximizes profits for you and your customers.

6. Margin Spot Module:

Enhance gains and risks for your customers with a sophisticated margin trading module housing flexible margin options, auto-deleveraging stop-loss integration, etc. Tiered margin ratios cater to different risk appetites, whereas automated risk management tools like those mentioned earlier minimize potential losses for traders in volatile crypto markets.

7. P2P Exchange, Lending and Borrowing:

Integrating these features makes your exchange software development worth your attention. There’s a huge trader base advocating trustless environments for trading, lending, etc. Simple P2P trading and an advanced lending module with diverse loan terms, interest rates, collateral options, etc. can enhance your platform’s credibility. Automated staking and yield optimization tools can also be integrated into your exchange app development plan.

8. Derivatives/Perpetual Futures Trading:

Focus on serving the maximum trader base by integrating as many trading modules as possible. You can support advanced order types, like trailing stops and basis trading for sophisticated derivatives traders. Dedicated market analysis tools specifically tailored for derivatives markets also empower informed trading decisions and enhance the prospects of success for your exchange platform development project.

9. NFT Marketplaces:

An all-encompassing experience makes users glued to your platform. The colossal success stories of Binance, Coinbase, and other prominent NFT marketplace-integrated exchanges are footsteps to follow for your success in the crypto domain. Given the profitability of NFT marketplaces, many existing and new exchanges are coming up with exchange app development plans. Fractional NFT ownership and curated NFT collections are all over the crypto space nowadays.

10. Crypto Cards:

Empower your customers to spend their crypto anywhere with seamless crypto-to-fiat conversion on prepaid crypto cards that mirror the functionality of conventional debit cards issued by banks. Leading crypto exchanges like Binance, Coinbase, and Crypto.com are already offering crypto cards to their customers and many other existing and new players are planning this integration.

Comments

Post a Comment