Launch Your Crypto Super App in Just 2 Weeks with a White Label Exchange Solution

The crypto superapp wave is entering Web3, and its influence is substantial enough to absorb hundreds of standalone apps. Coinbase Global Inc. recently unveiled its crypto super app strategy, inspired by China’s WeChat and Alipay, aiming to offer a comprehensive suite of financial services under one roof.

“Ultimately, we want to be a bank replacement for people.”

CEO Brian Armstrong

He also added that he wants to make every crypto payment “as fast, cheap and global as sending an email”. And it’s not just Coinbase, the pioneer crypto exchange software, but OKX, Kraken, Binance, and numerous other exchanges and wallets have integrated wallets, payments, DeFi, and more to offer unified experiences to end users.

What Are Crypto Superapps?

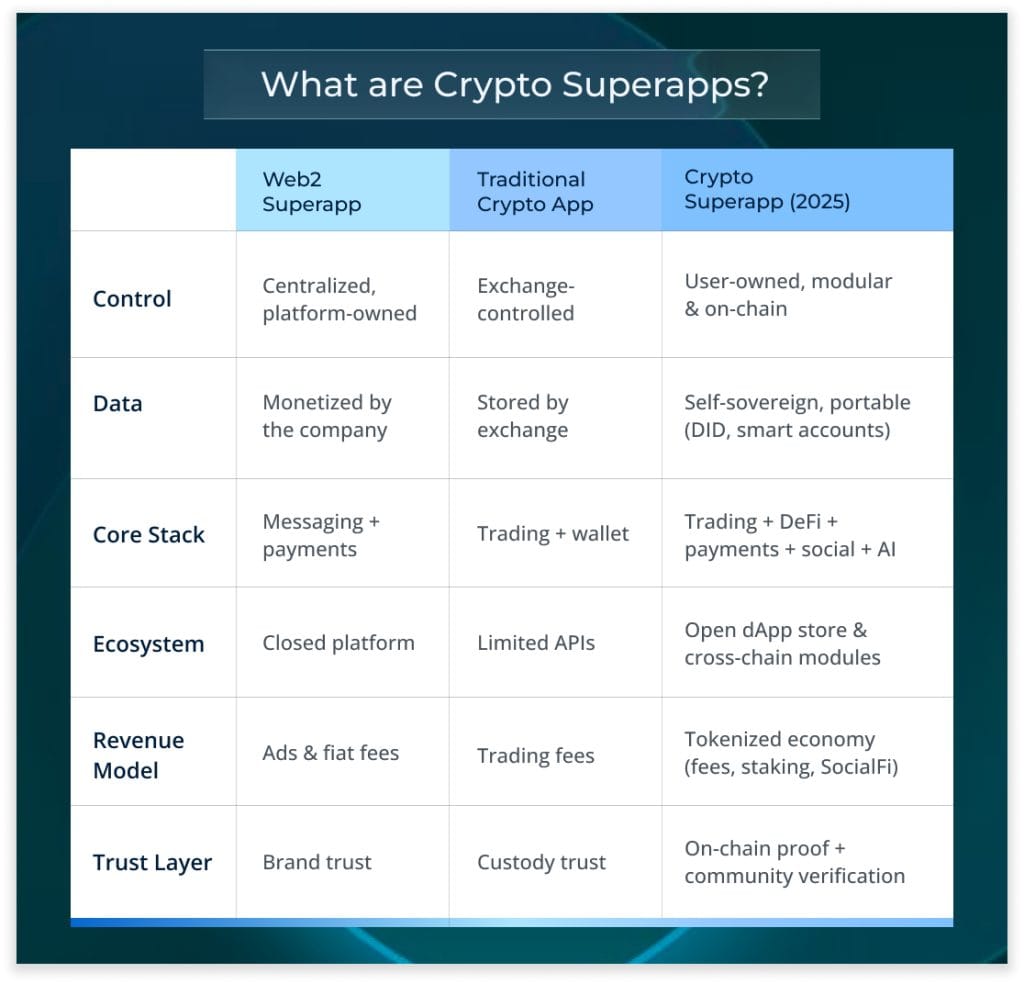

A crypto exchange and wallet combination with a social tab isn’t a superapp in 2025. That’s basic. Crypto superapps of 2025 and beyond are new species entirely, that can be termed as an ecosystem. A crypto app may be a collection of features. Still, a superapp is an infrastructure that brings together wallets, trading, DeFi, payments, identity, social modules, and external mini-apps in a modular, composable architecture. It’s no longer a utility application but a hub where users actually own and control their assets, data, and reputation without owning the platform.

- Unlike Web2 superapps that monetize user data, crypto trading superapps run on ownership logic that states that every transaction, credential, and reward is tied to a verifiable on-chain identity.

- New features can be plugged in or removed progressively, as all modules are secured through isolation layers and smart contracts.

- They work like plug-in compatible operating systems powered by liquidity routing and cross-chain connectivity mechanisms, hosting yield vaults, AI agents, mini dApps, and much more.

In short, crypto superapps replace custodial convergence with sovereign control, letting users trade, earn, pay, play, and interact, all without leaving a single interface.

How does Superapp Trend Influence Crypto Exchange Development?

If you’re planning to launch a cryptocurrency exchange software, you need to align your strategy with this mega trend before it goes mainstream and makes you a laggard. To stay future-ready, you must build a single app where users can:

- Tokenize RWAs

- Trade spot, futures, memecoins, RWAs, NFTs, etc.

- Store digital assets and manage their portfolio

- Stake, lend, borrow, and bridge assets

- Play mini games, participate in trading challenges

- Chat, access social feeds, copy-trade, and earn rewards

- Pay for goods in stablecoins

- Access AI-powered tools and analytics

- Send money to their near ones abroad

That’s the new crypto superapp stack shaping up to dominate Web3 in 2025.

How White Label Exchanges Accelerate Crypto Superapp Development?

A white label crypto exchange software is like a plug-and-play, prebuilt, fully functional crypto trading infrastructure that businesses can brand, customize, and deploy as their own platform. Essentially, it’s a “Crypto-as-a-Service” where the vendor handles:

- Core exchange engine (order book, trade matching, APIs)

- Wallet management and custody logic

- KYC/AML compliance modules

- Liquidity and market-making integrations

- Admin dashboard and reporting tools

Meanwhile, businesses that pay for white label crypto exchange development just control the branding, user experience, and go-to-market.

With premium white label crypto exchange software development or CaaS models like Antier’s, businesses can launch their crypto trading superapp in just 7 days.

Also Read>>> How to Build a Binance-Grade Exchange with Crypto-as-a-Service?

Comments

Post a Comment